| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| Personal Products |

8.32% |

|

| Godrej Consumer Products Limited |

3.31% |

|

| Dabur India Limited |

2.71% |

|

| Colgate Palmolive (India) Limited |

1.82% |

|

| Procter & Gamble Hygiene and Health Care Limited |

0.47% |

|

| Finance |

7.81% |

|

| Cholamandalam Investment and Finance Company Limited |

3.65% |

|

| SBI Cards & Payment Services Limited |

2.01% |

|

| Muthoot Finance Limited |

1.09% |

|

| Bajaj Holdings & Investments Limited |

1.06% |

|

| Retailing |

6.59% |

|

| Info Edge (India) Limited |

2.81% |

|

| Avenue Supermarts Limited |

1.94% |

|

| Zomato Limited |

1.12% |

|

| FSN E-Commerce Ventures Limited |

0.71% |

|

| Aerospace & Defense |

6.52% |

|

| Bharat Electronics Limited |

3.65% |

|

| Hindustan Aeronautics Limited |

2.88% |

|

| Cement & Cement Products |

6.30% |

|

| Shree Cement Limited |

2.58% |

|

| Ambuja Cements Limited |

2.53% |

|

| ACC Limited |

1.19% |

|

| Chemicals & Petrochemicals |

5.90% |

|

| Pidilite Industries Limited |

3.21% |

|

| SRF Limited |

2.69% |

|

| Insurance |

5.00% |

|

| ICICI Lombard General Insurance Company Limited |

2.78% |

|

| ICICI Prudential Life Insurance Company Limited |

1.80% |

|

| Life Insurance Corp of India |

0.42% |

|

| Electrical Equipment |

4.61% |

|

| Siemens Limited |

2.72% |

|

| ABB India Limited |

1.90% |

|

| Power |

4.54% |

|

| Tata Power Company Limited |

2.58% |

|

| Adani Green Energy Limited |

1.15% |

|

| Adani Transmission Limited |

0.81% |

|

| Banks |

4.51% |

|

| Bank of Baroda |

2.87% |

|

| Canara Bank |

1.64% |

|

| Consumer Durables |

3.88% |

|

| Havells India Limited |

2.60% |

|

| Berger Paints (I) Limited |

1.28% |

|

| IT - Software |

3.86% |

|

| LTIMindtree Ltd |

3.86% |

|

| Beverages |

3.46% |

|

| United Spirits Limited |

2.15% |

|

| Varun Beverages Limited |

1.31% |

|

| Auto Components |

2.96% |

|

| Samvardhana Motherson International Limited |

1.65% |

|

| Bosch Limited |

1.32% |

|

| Gas |

2.92% |

|

| GAIL (India) Limited |

2.29% |

|

| Adani Gas Limited |

0.63% |

|

| Petroleum Products |

2.72% |

|

| Indian Oil Corporation Limited |

2.72% |

|

| Diversified Metals |

2.68% |

|

| Vedanta Limited |

2.68% |

|

| Transport Services |

2.62% |

|

| InterGlobe Aviation Limited |

2.62% |

|

| Fertilizers & Agrochemicals |

2.55% |

|

| PI Industries Litmited |

2.55% |

|

| Realty |

2.46% |

|

| DLF Limited |

2.46% |

|

| Agricultural Food & other Products |

2.45% |

|

| Marico Limited |

2.22% |

|

| Adani Wilmar Limited |

0.22% |

|

| Textiles & Apparels |

1.83% |

|

| Page Industries Limited |

1.83% |

|

| Leisure Services |

1.56% |

|

| Indian Railway Catering & Tourism Corporation Limited |

1.56% |

|

| Capital Markets |

1.47% |

|

| HDFC ASSET MANAGEMENT COMPANY Limited |

1.47% |

|

| Pharmaceuticals & Biotechnology |

1.41% |

|

| Torrent Pharmaceuticals Limited |

1.41% |

|

| Telecom - Services |

0.86% |

|

| Indus Towers Limited |

0.86% |

|

| Cash & Current Assets |

0.19% |

|

| Total Net Assets |

100.00% |

|

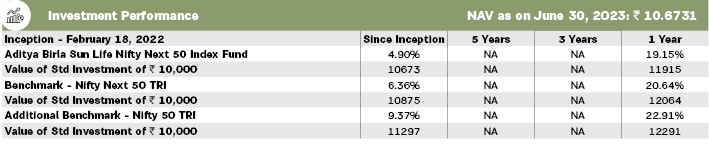

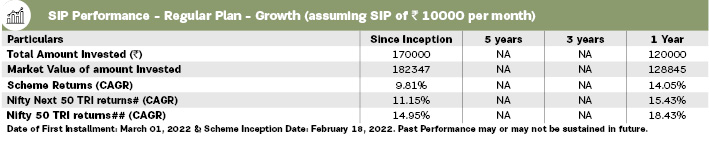

# Scheme Benchmark, ## Additional Benchmark, * As on start of period considered above.

For SIP calculations above, the data assumes the investment of

10000/- on 1st day of every month or the subsequent working day. Load & Taxes

are not considered for computation of returns. Performance for IDCW option would assume reinvestment of tax free IDCW declared at the

then prevailing NAV. CAGR returns are computed after accounting for the cash flow by using XIRR method (investment internal rate of return).Where

Benchmark returns are not available, they have not been shown. Past performance may or may not be sustained in future. Returns greater than

1 year period are compounded annualized. IDCW are assumed to be reinvested and bonus is adjusted. Load is not taken into consideration. For SIP

returns, monthly investment of equal amounts invested on the 1st day of every month has been considered.